Are you interested in buying land, building a home from scratch, or making renovations to an existing property? If so, then you're looking into financing your project with a construction loan. Construction loans have been helping homeowners, and commercial builders achieve their dreams for decades now - but how do they work exactly?

Read on for all the details about what goes into obtaining and using one of these specialized types of loans.

Construction Loans Work Introduction

Construction loans are short-term, intermediate financing that helps cover the costs of building or renovating a home. These loans are typically taken out over one year and have variable interest rates. Unlike more traditional mortgages, construction loans require that you provide plans and specifications for your project before they can be approved. This is to ensure that the lender is comfortable with the amount being borrowed and the project's end goal.

Qualifying for a Construction Loan

To qualify for a construction loan, borrowers will generally need to have good credit ratings and a stable source of income. The borrower should also provide detailed information about the proposed project, including floor plans, estimated costs, and a timeline for completion.

Lenders may also require that a third-party contractor or architect be involved in the project to ensure it is completed according to plan.

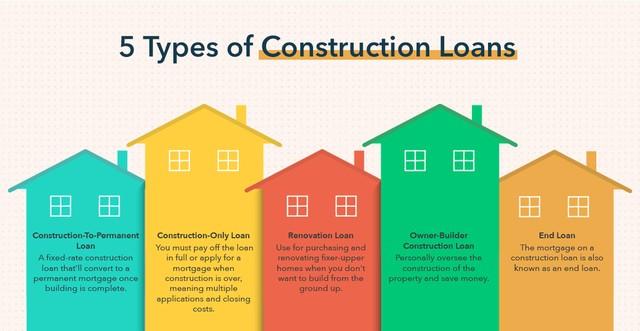

Types of Construction Loans

There are two main types of construction loans: single-close and double-close. With a single close loan, the borrower takes out one loan for both the construction costs and the end mortgage. This allows borrowers to lock in their interest rate from the start of the project until completion. In some cases, lenders may also require that you make payments on the loan while it is being built.

For those who don't qualify for a single-close construction loan, a double-close might be an option. With this type of loan, borrowers will take out separate financing for each project phase. This means the borrower will have to obtain a loan for the construction costs and refinance once the project is complete.

How Does A Construction Loan Work

A construction loan is a short-term loan designed to cover the cost of building or renovating a home. Construction loans are typically taken out by homebuyers who are planning on constructing their own property. The loan will cover the costs associated with materials, labor, permits, inspections, and other related expenses.

Renovation loan

In addition to new construction loans, there are also renovation loans. These loans can be used for residential and commercial properties and generally allow borrowers to borrow up to the property's value after renovations have been completed. This allows borrowers to finance their entire renovation project without spending money upfront.

End loan

Once a construction project is finished, the borrower must apply for an end loan. This loan pays off the construction loan and allows the borrower to keep the property as their own. End loans are typically taken out in fixed-rate mortgages and can be used for residential and commercial properties.

How Do Construction Loans Work

Construction loans are typically split into two separate parts - the initial funding phase and the long-term financing phase. During the initial funding phase, loan funds are released as needed throughout the construction to cover materials and labor costs associated with the project.

Once the project has been completed, a long-term financing pr, a product such as a more,t page can be used to pay off the loan balance.

Benefits of Construction Loans Work

Following are:

1. Construction loans allow borrowers to finance their projects with a single loan, reducing paperwork and other costs associated with multiple loans.

2. They can also help save money since they usually have lower interest rates than traditional mortgages.

3. Construction loans are flexible in terms of how much you can borrow and how long the loan term lasts, so you can structure your loan to fit your needs.

4. When it comes time to refinance after the construction project is complete, borrowers may qualify for more favorable terms due to improvements made during the construction process.

Using Your Construction Loan

Once you have your construction loan, it’s important to use it wisely. Make sure you pay attention to the details of your contract and stay within budget throughout the building process. Keeping careful records of all payments made on loans is essential in case any issues arise later. It’s also important to remember that interest will start accruing from day one, so borrowers should plan accordingly.

Kinds of Properties Are Eligible for a Construction Loan?

Generally speaking, most commercial and residential properties are eligible for construction loans as long as they meet the lender's criteria for creditworthiness and other requirements. Extra documentation may be required to secure your loan, depending on the type of project you are undertaking.

Potential Risks Involved With Construction Loans?

As with any loan, there are risks associated with a construction loan. Most notably, there’s always a risk of defaulting on the loan if you can’t complete your project or don’t meet all of its obligations.

Additionally, construction loans can be more expensive and time-consuming than other types of mortgages - so it’s important to weigh the pros and cons before making any decisions.

Things You Should Know Before Applying for a Construction Loan?

Before applying for a construction loan, it's important to make sure you understand all of the terms and conditions associated with the loan. You should also be prepared to provide detailed financial information and documentation to your lender to secure the best possible loan terms.

Additionally, before making any commitments, reviewing potential risks carefully is important. Finally, ensure you have a realistic plan for repaying the loan once your project is completed. Doing these things will put you in the best possible position when it comes time to apply for your construction loan.

FAQs

What is a Construction Loan?

A construction loan is a short-term loan secured by real estate to fund the building or renovation of a property. These loans are typically used for residential and commercial projects, allowing borrowers to obtain financing to complete their projects from start to finish.

Who are Construction Loans For?

Construction loans can be used by anyone looking to build or renovate a property, including residential and commercial builders. They are also perfect for investors who may want to purchase a distressed property that needs repairs.

How Do I Apply for a Construction Loan?

Applying for a construction loan is similar to applying for any other type. You will need to provide the lender with detailed financial information, plans, and cost estimates for your project. Your lender may also require you to provide evidence that the property has legal title and that you have the necessary permits and licenses before funding your loan.

What Are the Benefits of Taking Out a Construction Loan?

Although some potential risks are associated with taking out a construction loan, they can also offer several benefits. For one, it gives you access to funds that may not be available through other financing options. Additionally, because construction loans are typically short-term, you don’t have to worry about long-term commitments or interest rates.

Where Can I Get More Information About Construction Loans?

If you’re looking for more information about construction loans, your best bet is to speak with a qualified financial professional. They can provide you with detailed answers to any questions or concerns you may have and help guide you through the process of obtaining a construction loan.

Conclusion

Construction loans offer borrowers a unique way to finance their building or renovation projects. They can be incredibly helpful in helping them get the funding they need without having to put any money down upfront. Borrowers must understand how these loans work before applying to ensure they qualify and have all necessary documents ready before diving into a project. These loans can help borrowers achieve their home-building and renovation dreams with some preparation.