Regarding investments, monthly dividend ETFs offer a great way to build up your retirement savings through the power of dividends. With a steady income stream and low fees, these ETFs allow investors to diversify their portfolios while earning consistent returns over time.

Whether looking for reliable passive income or long-term growth potential in the stock market, Monthly Dividend ETFs provide an ideal solution. In this post, we'll explore what makes them attractive and how they can benefit your investment goals—so that you can make informed decisions when planning for your secure financial future.

What are Monthly Dividend ETFs, and how do they work

Monthly Dividend ETFs, also known as Monthly Payout ETFs, refer to a type of Exchange Traded Fund (ETF) that provides investors with recurring distributions on a monthly or quarterly basis. Monthly dividend ETFs are a great investment option for those who need regular cash flow and want to diversify their portfolio without taking on additional risk.

Monthly dividend ETFs invest in stocks, bonds, commodities, and other assets with an established record of paying regular dividends. The underlying portfolios' performance determines the value of each share and the number of dividends paid out to holders over time.

Monthly dividend ETFs provide higher returns than other investments, such as traditional savings accounts or money market funds. Investors can benefit from Monthly Dividend ETFs as they provide investors with a source of income and long-term capital appreciation.

Monthly dividend ETFs are managed by professional fund managers who monitor the underlying securities' performance and adjust the portfolio accordingly. They work like any other ETF, but unlike traditional ETFs that pay out dividends once or twice a year, Monthly Dividend ETFs pay out dividends more frequently.

The benefits of investing in Monthly Dividend ETFs

Monthly Dividend ETFs allow investors to reap steady, reliable income every month. These funds allow investors to create a consistent stream of dividend income without worrying about timing stock prices or waiting for quarterly payouts.

Lastly, Monthly Dividend ETFs offer investors convenience; investors do not need to research and select individual stocks or bonds on their own – instead, Monthly Dividend ETFs provide a diversified portfolio of investments that can be easily managed with minimal effort.

Through Monthly Dividend ETFs, investors can create a steady stream of income while protecting themselves against risks associated with stock market fluctuations and enjoy the convenience of investing in one fund rather than having to manage multiple investments.

Monthly Dividend ETFs can be ideal for those looking to grow their assets while still generating consistent monthly income. Investing in Monthly Dividend ETFs allows investors to take advantage of the benefits of both dividend income and long-term capital appreciation.

With Monthly Dividend ETFs, investors can enjoy a steady stream of monthly income and benefit from any potential market gains from their underlying investments over time.

The top 5 Monthly Dividend ETFs to consider for your portfolio

Monthly dividend ETFs can allow investors to collect regular distributions while also providing exposure to a diversified portfolio of underlying securities. Monthly dividend ETFs offer different structures and investment strategies, including high-yield, equity, and bond funds. Here are the top five Monthly Dividend ETFs to consider for your portfolio:

1) iShares Monthly High Yield Corporate Bond ETF (HYMB): This fund tracks the performance of U.S. dollar-denominated corporate bonds that pay monthly dividends. The fund has earned $2 billion in assets under management since its inception in 2008 and offers a yield of over 6%.

2) SPDR S&P International Dividend ETF (DWX): This fund tracks the performance of dividend-paying international companies. The fund has earned $1 billion in assets under management and offers a yield of over 5%.

3) PowerShares Monthly Dividend Fund Achievers ETF (PDVD): This fund tracks the performance of U.S. stocks that have consistently paid monthly dividend payments for at least ten years. The fund has earned $350 million in assets under management and offers a yield of over 3%.

4) iShares Monthly Dividend ETF (DVY): This fund tracks the performance of large-cap U.S. stocks that pay out regular monthly dividends, emphasizing quality and growth potential. The fund has earned $2 billion in assets under management and offers a yield of over 2%.

5) First Trust Monthly Dividend ETF (FDT): This fund tracks the performance of large-cap and mid-cap U.S. stocks that pay out consistent monthly dividends. The fund has earned $550 million in assets under management and offers a yield of over 8%.

How to choose the right Monthly Dividend ETF for you

When selecting Monthly Dividend ETFs, it's important to consider the fund's underlying holdings and risk/return profile. Monthly dividend ETFs typically have a variety of underlying investments, ranging from large-cap stocks to mid-cap and small-cap stocks or bonds.

Depending on your risk tolerance and goals, you should focus on Monthly Dividend ETFs specializing in one sector or asset class.

It's also important to understand the total expense ratio (TER) associated with Monthly Dividend ETFs before investing. The TER measures the weighted average of all fees an ETF charges for managing its portfolio; these fees can take a significant bite out of any returns the fund generates.

Monthly dividend ETFs can offer investors the potential for both income and long-term capital appreciation. Still, it's important to select funds with reasonable TERs to maximize your returns.

Finally, Monthly Dividend ETFs should also be evaluated relative to their peers in terms of performance; some Monthly Dividend ETFs may have higher yields than others, but they might also come with greater levels of risk or volatility.

Before investing in a Monthly Dividend ETF, research its historical performance and compare it to similar funds before deciding.

The risks associated with investing in Monthly Dividend ETFs

Although Monthly Dividend ETFs can offer investors the potential for income and capital appreciation, it's important to understand the risks associated with investing in these funds. Monthly Dividend ETFs are typically made up of a basket of securities. They, therefore, carry many of the same risks as stocks and bonds, including market risk, inflation risk, interest rate risk, and credit risk.

Additionally, Monthly Dividend ETFs may only distribute dividends some months, especially when markets are volatile or if underlying securities perform differently than expected. As such, Monthly Dividend ETFs should be considered a long-term investment rather than an immediate source of income.

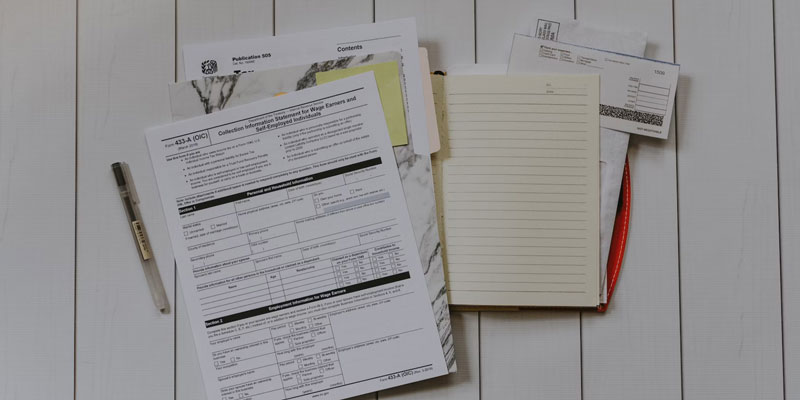

Finally, Monthly Dividend ETFs may be seen as less tax-efficient than other investments since their dividends are subject to taxation. This can significantly reduce the potential returns from Monthly Dividend ETFs and should be considered when selecting funds for investment.

FAQs

Which ETF pays monthly dividends?

There are several Monthly Dividend ETFs on the market, including iShares Monthly Dividend ETF (DVY), First Trust Monthly Dividend ETF (FDT), and SPDR S&P Monthly Dividend ETF (SDY).

Are Monthly Dividend ETFs appropriate for all investors?

Monthly Dividend ETFs can offer investors the potential for income and capital appreciation. Still, they come with many of the same risks as stocks and bonds and may only be suitable for some investors.

Before investing in a Monthly Dividend ETF, it's important to understand its underlying holdings, total expense ratio (TER), historical performance, and risk/return profile to make an informed decision.

Is there a way to reduce the tax burden associated with Monthly Dividend ETFs?

Yes, investors can use certain strategies, such as tax-loss harvesting or asset location, to minimize the taxes owed on Monthly Dividend ETF investments. A

Additionally, investors may take advantage of lower capital gains rates if they hold Monthly Dividend ETFs for more than one year. It's important to consult a financial advisor or tax professional before investing in Monthly Dividend ETFs.

Conclusion

Investing in Monthly Dividend ETFs can be incredibly lucrative and wise for anyone looking to diversify their investment portfolio and maximize their earning potential. Knowing how these ETFs work and the top ones you should consider will give you the confidence to make informed decisions. Remember to find out what risks are associated with Monthly Dividend ETFs so you can mitigate them accordingly.

Considering everything, it is clear that savvy investors should take notice of this type of investment opportunity. With carefully calculated decisions and ongoing research, Monthly Dividend ETFs can provide a steady income stream for many years. So take some time to investigate your options and ensure monthly dividends become part of your financial plan. It will be one of the best decisions you ever make.