Do you have a business and dread filing taxes? If so, you're not alone. Every year, countless businesses need help to complete their paperwork on time and pay high fees for help. But don't panic—there are numerous ways to file your taxes for free!

Whether it's learning about tax deductions or seeking professional advice from experts in the field, there is something out there that can make the tax season less daunting.

In this post, we'll explore several business tax filing methods without paying anything and provide tips to make filing hassle-free and straightforward. So stick with us until the end of our journey into tax preparation—you may just be surprised at how easy it can be!

Understand and research the forms you need to fill out

Before you start filing your business taxes, it's important to understand exactly what forms must be filled out and when they are due. The IRS has a comprehensive list of all the forms required for different types of businesses.

Take the time to research each form to understand how to complete it properly. This will make filing easier and faster.

Familiarize yourself with the tax filing deadlines

The first step to filing your business taxes for free is to become familiar with the tax filing deadlines. Knowing when taxes are due and when to submit your paperwork can help you plan and save time during the filing process.

Additionally, waiting too long to submit your paperwork could incur late fees or fines. A good way to stay on top of the deadlines is to set reminders or keep a calendar with all the due dates.

Spreadsheet Templates for Small Business Taxes

If you're a small business owner, spreadsheet templates can be an excellent way to keep track of your finances and make filing taxes easier.

Many free online resources offer customizable spreadsheets for tracking income, expenses, deductions, etc. These templates can help you stay organized so that filing becomes simpler and less stressful.

Online Tax Calculators and Refund Estimators

Many websites offer free online tax calculators and refund estimators. These tools can be a great way to better understand your taxes and the deductions you're eligible for.

They can also help estimate how much money you may save or owe after filing. This is extremely beneficial, as it can help you plan and ensure you have enough money for taxes.

Take advantage of free tax filing software

Tax filing software can help you navigate complex tax regulations and ensure accurate filings. Fortunately, various free online tools available for businesses, such as FreeTaxUSA and TurboTax, allow you to prepare and file your taxes easily.

These programs are user-friendly, with step-by-step guidance for filing Form 1040, Schedule C (profit or loss from business), and other business tax forms.

Obtain a free IRS e-filing PIN or EIN:

One of the best ways to file business taxes for free is by obtaining an IRS e-filing PIN or Employer Identification Number (EIN). Both provide a unique identifier you can use when filing taxes online.

The EIN is required if your business has employees, while the e-filing PIN is used as a signature and is needed if you want to file electronically. The IRS provides both numbers for free and can be obtained from their website.

You can also take advantage of resources on the Internet like TurboTax or H&R Block to help you with your taxes. These sites provide free online tax filing and will walk you through the process step-by-step.

Additionally, they offer a variety of resources to help you understand what deductions are available and how to maximize them. Finally, you can contact local accounting firms in your area for assistance with filing taxes, as many offer free consultations or even discounted services for small businesses.

No matter which route you choose, there are plenty of ways to file your business taxes without paying anything. With the right strategy and a little knowledge, you can make this tax season hassle-free and stress-free!

Utilize free software programs offered by the IRS to file your taxes:

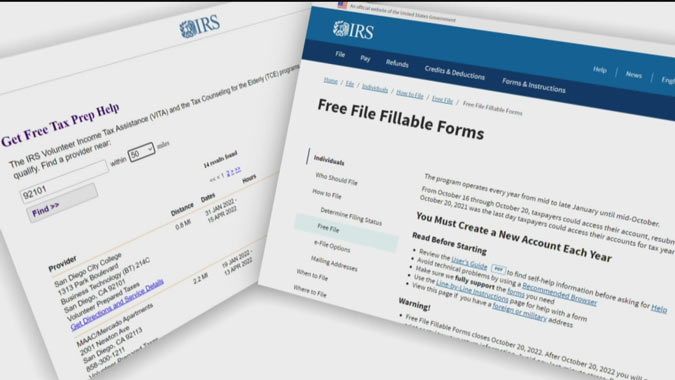

The Internal Revenue Service (IRS) offers software programs that allow you to file your business taxes for free. These programs are user-friendly and designed to simplify the filing process, allowing you to submit all required documents quickly and accurately.

You can also utilize their online tools, such as the Interactive Tax Assistant or IRS2Go app, to get answers to your questions.

Take advantage of free tax preparation services

if you need help with paperwork. The Internal Revenue Service (IRS) offers free tax preparation services through its Volunteer Income Tax Assistance program, available to businesses and individuals with incomes below a certain threshold.

You can find local volunteer sites through the IRS website. Many states also offer their versions of this service, so check your state's website for more information.

Tax preparation software programs are also available to help you file your taxes accurately and quickly. The IRS provides free access to its filing system and several other reputable programs like TurboTax and TaxAct.

Understand the tax breaks available to your business. Before you start filing, research the tax deductions and credits available to your business. Knowing these can help you save money by reducing your taxable income.

For example, a small business owner may be eligible for the Small Business Health Care Tax Credit or the simplified home office deduction. Additionally, take advantage of other deductions and credits, such as charitable contributions or energy-efficient improvements.

FAQs

How do I file taxes if I own my own business?

Filing taxes for your business can be a complicated and time-consuming process. However, there are ways to file your business taxes without paying anything. You can take advantage of free online tax filing software and seek advice from experts in the field before submitting your paperwork.

How do small businesses avoid paying taxes?

Small businesses can avoid paying taxes by taking advantage of certain tax deductions and credits. These include the Small Business Health Care Tax Credit, the Retirement Savings Contribution Credit, and the Home Office Deduction.

Additionally, small businesses may be eligible for other special tax breaks that can reduce their overall tax burden.

What are the best tips for filing business taxes?

When filing business taxes, it's important to stay organized and keep track of all expenses, income, and deductions. Additionally, you should ensure you are taking advantage of any special tax breaks or credits available to your small business.

Finally, seeking professional advice from experts in the field can help ensure that everything is done accurately and on time.

Conclusion

Filing taxes can be daunting for businesses, but it doesn't have to be. You can file your business taxes for free with the right knowledge and resources. Whether you take advantage of online tax programs or seek advice from experts in the field, there are numerous ways to ensure that you comply with all necessary regulations. Don't be intimidated by the tax process—instead, take control of your taxes and set yourself up for success. With the right preparation, you can ensure that filing your business taxes is hassle-free and straightforward.