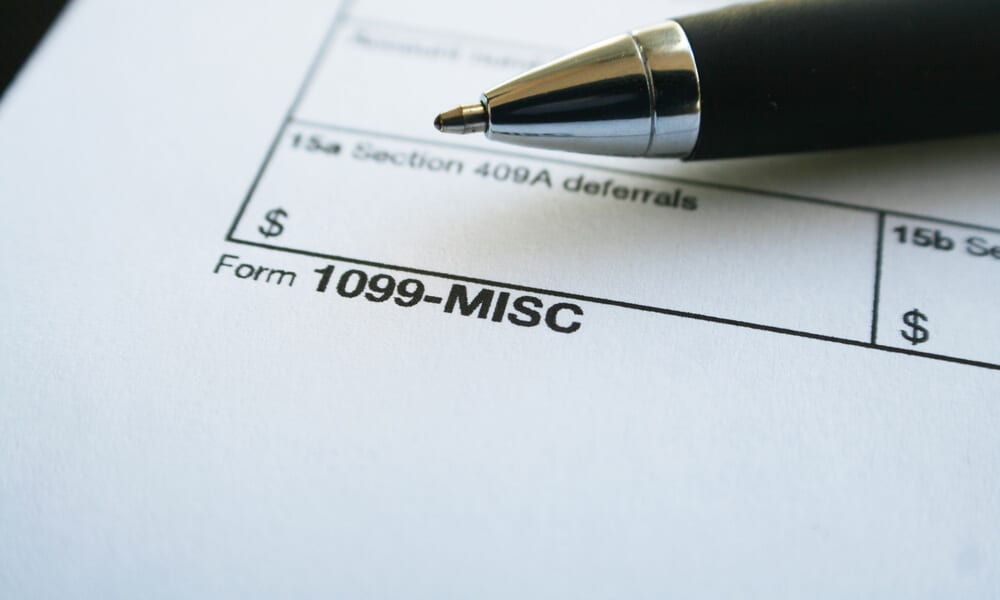

It's crucial to learn about IRS paperwork before tax season. Form 1099-Q reports eligible education program payouts. By understanding the nuances of Form 1099-Q, you can ensure compliance with tax regulations and effectively manage your educational expenses.

What is IRS Form 1099-Q?

IRS Form 1099-Q, also known as the "Payments from Qualified Education Programs," is an IRS form that reports distributions from qualified education savings programs. These programs typically include Coverdell Education Savings Accounts (ESAs) and Qualified Tuition Programs, commonly known as 529 plans. The banking institution or nonprofit will be handling the educational savings account and issuing the form as well.

The purpose of Form 1099-Q is to inform both the recipient of the distribution and the IRS about the amount of money withdrawn from the qualified education program during the tax year. The form determines the distribution's taxability and eligibility for education tax advantages.

Who Needs to File Form 1099-Q?

Financial institutions or trustees that manage qualified education programs are generally responsible for filing IRS Form 1099-Q. The beneficiary and IRS must get a copy of the finished form. The student or account recipient uses Form 1099-Q to appropriately record the payout on their tax return.

You're a qualifying education program account holder or you got a distribution throughout the tax year. If so, the administering organization will send Form 1099-Q. The form must be accurate and kept for tax filing.

What are the Components of Form 1099-Q?

Form 1099-Q consists of sections that capture essential details about distributing a qualified education program. Let's explore the critical components of the form:

Recipient's Information

The recipient's name, address, and TIN are needed here. SSN or ITIN is usually the recipient's TIN. Accurate recipient information is crucial for tax reporting and identification purposes.

Payer's Information

This section records the player’s name, address, and taxpayer identification number (TIN). The payer is the financial institution or trust that administers the qualified education program. Providing accurate payer information ensures proper identification and communication with the administering entity.

Account Number

The account number section requires the unique identifier associated with the recipient's account in the qualified education program. This number helps link the distribution information to the specific account, ensuring accurate record-keeping and identification.

Distributions Made

Box 1 of Form 1099-Q reports the total distributions from the qualified education program during the tax year. It includes all distributions made, regardless of whether they were used for qualified educational expenses. This information is vital for determining the taxability of the distribution.

Earnings Portion

Box 2 captures the portion of the distribution that represents earnings on the account. It reports the earnings or growth of the account balance and helps determine the tax implications of the distribution. The earnings portion may be subject to taxation, depending on how the distribution is used.

Basis

Box 3 of Form 1099-Q reports the basis, representing the contributions or principal previously withdrawn tax-free from the account. It includes any contributions to the qualified education program that were not previously distributed. The basis is used to determine the taxable portion of the distribution.

How to File Form 1099-Q?

If you are the financial institution or trustee responsible for administering qualified education programs, here are the steps to complete and file Form 1099-Q:

Gather Information

Form 1099-Q requires precise data collection. This comprises the recipient's name, address, TIN, payer's information, account number, and tax year-eligible education program disbursements.

Enter Recipient and Payer Information

Form 1099-Q requires the recipient's name, address, and TIN. Enter the player’s name, address, and TIN. Ensure accuracy and double-check the information entered.

Report Distributions

In Box 1, enter the total distributions made from the qualified education program during the tax year. Include all distributions made, including partial withdrawals or rollovers.

Indicate Earnings and Basis

In Box 2, report the portion of the distribution representing earnings on the account. This information helps determine the taxability of the distribution. In Box 3, enter the basis amount, which means the contributions or principal previously withdrawn tax-free from the account.

Check for Accuracy and Furnish Copy B

Review all the information entered on Form 1099-Q for accuracy. Double-check names, addresses, and numbers to ensure correctness. Once verified, provide the recipient with Copy B of Form 1099-Q by January 31st of the following tax year. Use a secure delivery method, such as certified mail, and retain a copy for your records.

File with the IRS and Retain Copy C

File Form 1099-Q with the IRS by the designated deadline. If filing on paper, send Copy A of Form 1099-Q and Form 1096 to the IRS. If filing electronically, follow the appropriate guidelines and instructions. Retain Copy C of Form 1099-Q for your records, as it documents the filed form.

Do I Have to Report 1099-Q on My Tax Return?

Yes, you are generally required to report the information from Form 1099-Q on your tax return. Form 1099-Q reports distributions from qualified education programs, and recipients of these distributions must include the information on their tax returns. The form lists the payout total (Box 1), earnings component (Box 2), and contribution basis (Box 3). Distributions for eligible educational costs are taxed differently. Qualified distributions are tax-free, but earnings beyond qualified expenses may be taxed and penalized.

Yes, you are generally required to report the information from Form 1099-Q on your tax return. Form 1099-Q reports distributions from qualified education programs, and recipients of these distributions must include the information on their tax returns. The form lists the payout total (Box 1), earnings component (Box 2), and contribution basis (Box 3). Distributions for eligible educational costs are taxed differently. Qualified distributions are tax-free, but earnings beyond qualified expenses may be taxed and penalized.

Review Form 1099-Q for completeness and put it on the relevant tax return lines to comply with IRS standards. Forms 1040 and 1040A have different lines and sections for reporting this information. Submit Form 1099-Q dividends on your tax return to avoid fines or extra taxes. Consulting the instructions or seeking guidance from a tax professional can help ensure accurate reporting.

Conclusion

Form 1099-Q plays a crucial role in reporting distributions from qualified education programs. Whether you are the distribution recipient or the administrator of such programs, understanding the purpose and requirements of Form 1099-Q is vital for accurate tax reporting. By ensuring the form is completed correctly and filed on time, you can fulfill your tax obligations and maintain compliance with IRS regulations. Should you have any uncertainties or questions, consult a tax professional or refer to the IRS instructions and resources related to Form 1099-Q.