Do you understand the role of a debt collector? Are you intimidated by those calls asking for payment on bills you may have forgotten about or never knew existed? It can be quite intimidating to deal with debt collectors; however, it is important to understand their rules and regulations so that when faced with them, you can feel empowered.

In this post, we will explore what debt collector is and how they operate to better prepare you for your next conversation.

Definition of a Debt Collector

A debt collector is a professional, typically employed by a collection agency or creditor, who contacts people that owe money to collect payments. Debt collectors are often seen as intimidating figures and may attempt to use aggressive tactics to try and obtain payment from debtors. Consumers need to understand the rules and regulations governing debt collectors to feel empowered during conversations with them.

Debt collectors must abide by the Fair Debt Collection Practices Act (FDCPA), which regulates how and when they communicate with debtors. This includes not calling before 8:00 am or after 9:00 pm, limiting contact attempts to within 30 days of receiving notice of an unpaid debt, not using profane language or threats of violence, and not using false information or deceptive tactics.

In addition to understanding the FDCPA, debtors must know their rights when dealing with debt collectors. Debtors can request verification of the debt in writing if the debt collector has not provided one already, dispute any errors in the amount owed, or request a payment plan that works best for them. Remembering that debt collectors must follow the FDCPA when contacting debtors can help empower debtors during conversations.

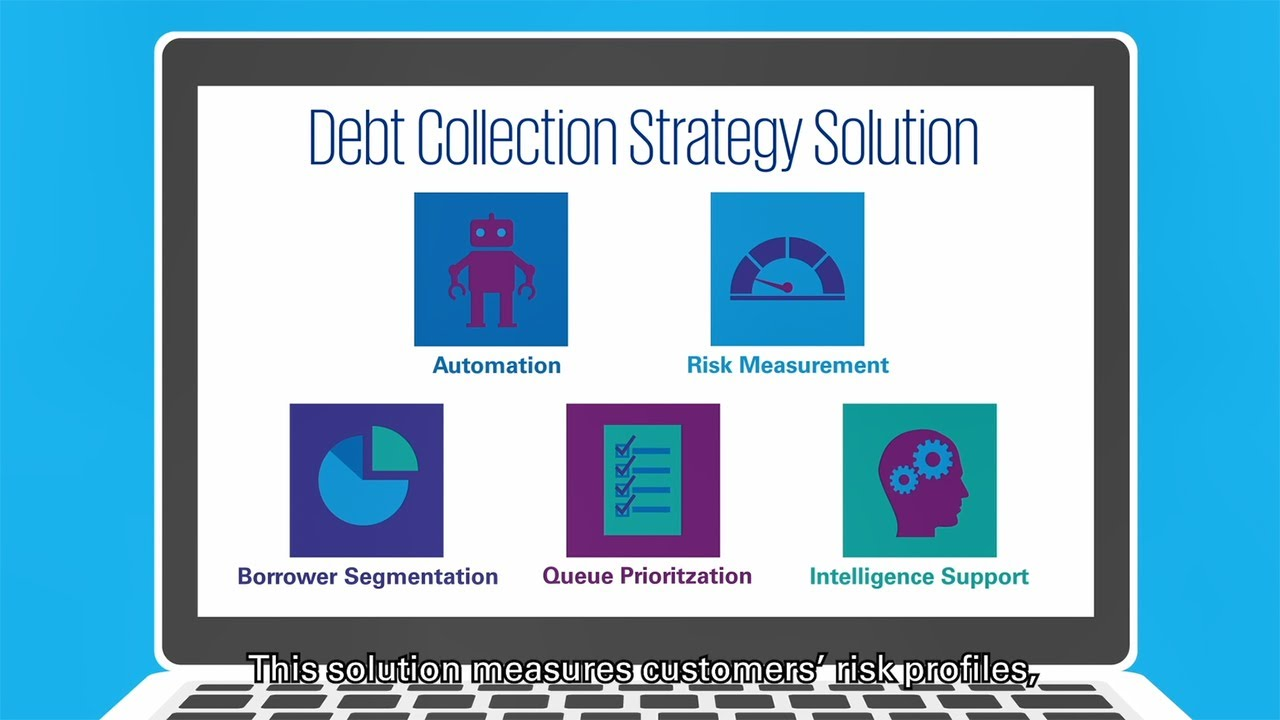

How a Debt Collector Works

When a debt collector contacts you to collect on an unpaid debt, they will first attempt to verify the amount owed and provide proof of the debt. They may also contact your other creditors or credit bureaus as part of this process. Once they have determined the amount due, they may then negotiate a payment plan with you that works for both parties.

Debt collectors can communicate with you via telephone, mail, email, or text message; however, all communication must comply with the Fair Debt Collection Practices Act (FDCPA). This includes limiting calls to within 30 days of receiving notice of an unpaid debt and not using profane language or threats of violence. The FDCPA also prohibits debt collectors from using false information or deceptive tactics.

Once a payment plan has been established, the debt collector may follow up with you to ensure that payments are made as agreed upon. If payments are not included or made in full, they will contact you to discuss the issue and try to devise another arrangement. It is important to keep communication open with your debt collector to resolve any issues quickly and amicably.

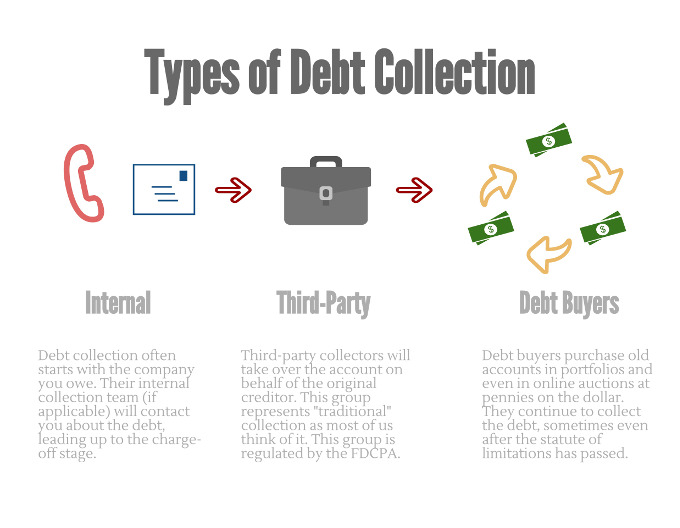

Types of Debt Collectors

There are two primary types of debt collectors: first-party and third-party debt collectors. First-party debt collectors are typically employed directly by the original creditor, such as a bank, credit card company, or hospital. They generally have more leeway when collecting debts since they are working for the original creditor and can provide payment plans or other options to help customers get their accounts back in good standing.

On the other hand, third-party debt collectors are employed by companies specializing in recovering past-due individual payments. These companies purchase unpaid debts from creditors at a discount and then attempt to collect them. Third-party debt collectors often use aggressive tactics to try and obtain payment, such as threatening to sue or calling frequently. It is important to remember that third-party debt collectors must still abide by the Fair Debt Collection Practices Act (FDCPA).

No matter which type of debt collector you are dealing with, it is essential to understand your rights and know how they operate to feel empowered when communicating with them. Be sure to ask for verification of the debt in writing and dispute any errors found on your account. Remember that the FDCPA governs first-party and third-party debt collectors can help you remain confident during conversations regarding your unpaid debts.

Rights of Consumers in Regards to Debt Collection

The FDCPA provides several protections to consumers when dealing with debt collectors. Debtors can request that debt collectors validate the debt in writing, and if any errors are found on the account, they can dispute them. The FDCPA also prohibits debt collectors from using abusive or threatening language during communication and calling excessively or at inconvenient times.

In addition, the FDCPA also prohibits debt collectors from making false statements or misrepresenting the amount owed, communicating with third parties about the debt without permission from the consumer, and attempting to collect more than what is owed. Knowing your rights under the FDCPA is essential for any debtor faced with a debt collector.

Strategies for Dealing with a Debt Collector

If a debt collector contacts you, it is important to remain calm and professional. Ask for verification of the debt in writing and review any documents provided carefully to ensure everything is correct. You may also request additional evidence of the debt, such as copies of payment statements or documentation of the original agreement with the creditor. If there are any errors on your account, dispute them immediately.

Negotiating with a debt collector can be intimidating, but remember that they also have limits. Reasonable payment plans can usually be established if both parties communicate openly and respectfully. Keep track of all communication between you and the debt collector and document any agreements made regarding payments or other arrangements related to your debts. Above all, remember that you have rights as a consumer, and understanding how debt collectors operate will help you remain empowered during these conversations.

Tips to Avoid Falling into Debt with Collectors

To avoid getting into debt with collectors in the first place, it is important to keep track of your finances and budget each month to be aware of how much you owe at all times. Pay bills on time and set up automatic payments.

Contact a credit counseling agency for guidance if you have difficulty managing your debts. Remember that debt collectors have rules they must abide by, so understand your rights as a consumer when communicating with them.

FAQs

Q: How Do Debt Collectors Operate?

A: Generally speaking, a debt collector will first attempt to contact the debtor via written correspondence (such as a letter or email). If this does not succeed, they may start attempting phone calls. The debt collector will continue trying to contact the debtor until they have successfully collected the debt or exhausted their resources.

Q: How Can I Protect Myself from Debt Collectors?, How Do Debt Collectors Operate?

A: Certain laws established by the FDCPA protect consumers from unfair practices when it comes to debt collection. This includes prohibiting threats of violence, using obscene language, and harassing tactics. Additionally, you can always exercise your right to request validation of the debt in writing from the creditor and debt collector. Be aware that any payment agreements should be received in writing, if possible. Ultimately, it is important to stay informed of your rights so that you can identify unfair practices and take the necessary action to protect yourself.

Q: What Should I Do If I Can’t Pay a Debt Collector?

A: Certain measures may be taken to help manage debt, depending on your financial situation. Some of these include consolidating or refinancing loans, requesting a deferment or forbearance from creditors, applying for assistance programs, negotiating repayment terms with creditors/debt collectors, settling debts for less than the full balance due (if applicable), or filing bankruptcy. Speaking with a professional about which options might be best suited for your needs is important.

Conclusion

Dealing with debt collectors can be intimidating and overwhelming. However, understanding the role of a debt collector, their methods for collecting debts, and your rights as a consumer will help you to feel more informed and empowered when navigating this process. Hopefully, this post has provided valuable information about debt collection that will better prepare you for future conversations with debt collectors.